Power of Alternative Data: GTCOM Hong Kong Trading Link 100 Index

Introduction

GTCOM Hong Kong Trading Link 100 Index, developed by Global Tone Communication Technology Co., Ltd. (hereafter called “GTCOM”), has been launched by GTCOM and Shenzhen Securities Information Company Limited (SSIC), a technology company under Shenzhen Stock Exchange. It serves as a benchmark index of the Hong Kong Stock Connect market. Based on the alternative receipt factors (sentiment, panic, buzz, etc.) generated by the deconstruction of GTCOM’s NLP algorithm, the index selects the top 100 stocks in the comprehensive ranking of investment value in the Hong Kong Stock Connect under Shenzhen-Hong Kong Connect and reflects the stock price movements of core quality listed companies in the Hong Kong Stock Connect market, providing a good performance benchmark for the market. The index has been launched on the official index platform CNI Index, with a code of 980005. It can be viewed on Wind terminal and App.

GTCOM Hong Kong Trading Link 100 Index released on CNI Index

GTCOM Hong Kong Trading Link 100 Index Published on Wind Terminal

GTCOM’s Main Alternative Data Factors:

Sentiment factor:

According to the daily average emotional value of individual stock information, five-level fine-grained categories include positive+, positive, neutral, negative and negative+.

Buzz factor:

The weighting algorithm for the change degree of positive/negative information volume of individual stocks reflects the activity of individual stocks in the stock market, quickly identifying market hotspots.

Signal factor:

The fundamental financial data (opening price, closing price, or 52-week high/low, etc.) of individual stocks are fitted. 20-plus factors such as big data-based media factors and elements are used to analyze and judge the trend of individual stocks.

Market sentiment factor

The market sentiment index reflects investors’ attention to the stock market. The higher sentiment indicates that the market pays more attention to the stock and is more likely to facilitate the transaction.

Panic factor

The panic index consists of a series of sub-factors reflecting negative emotions, such as underweight, sell-off, selling pressure and sharp falls. The rising panic index can result in higher market risks, growing negative emotions of declining stock indexes, and greater possibilities of market decline. Investors should be cautious in making investment to avoid risks.

Data set

The data set includes market fundamentals data as well as alternative data of GTCOM’s

alternative data analysis platform JoveBird (https://www.jovebird.com).

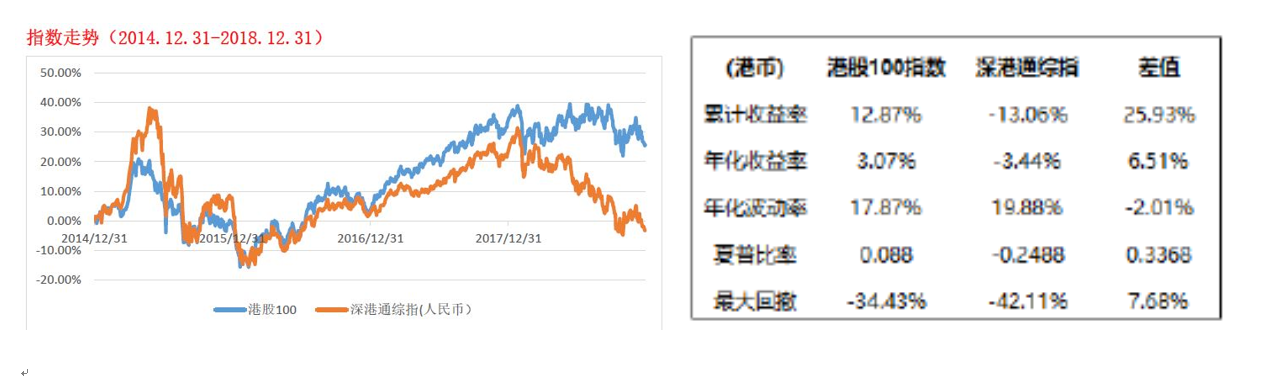

Exponential performance

Based on the backtesting of data from January 2015 to January 2018, GTCOM Hong Kong Trading Link 100 Index outperformed the Shenzhen-Hong Kong Connect Composite Index by 25.93% in cumulative return rate and by 6.51% in annualized rate of return.